Financial Coaching

Do you ever get that nagging feeling that you're just not doing enough to set a solid financial foundation for your family? And it feels even more frustrating because you're really good at your job, so why is money so hard to get a handle on sometimes?

In an ideal world, you'd be:

- Saving for retirement

- Traveling and having fun experiences without feeling guilty

- Free of credit card debt and student loan payments

- Able to support your child(ren) into adulthood one day, maybe by paying for college or helping with a down payment

- Teaching your children how to manage their own money, so they can start their lives in an even better place than you did.

But it's not always easy to reach those ideals on your own.

Maybe you tried budgeting in the past, but it was complicated and you were too busy with work and family commitments to stick with it.

Maybe you tried giving your kids an allowance, but they just ended up spending it on frivolous things.

Maybe things have been "good enough" for a long time, and you're finally ready for them to be extraordinary instead.

I've been there. I've navigated my way through an 18-year systems engineering career with NASA and parenting two wonderful girls, all while building budgeting systems, managing our finances, and teaching our kids about money in a way that has set us all up for a stable future.

And I want the same for you!

I can help you get your financial life in order and implement a money management system so you feel in control of your finances within the limited amount of time you have outside of work and family.

It's time to go beyond the bank account and get confident in your family's financial future.

Got questions? I've got answers! Book a free 15 minute Q&A call to discuss how I can help you through financial coaching.

Who I Can Best Serve

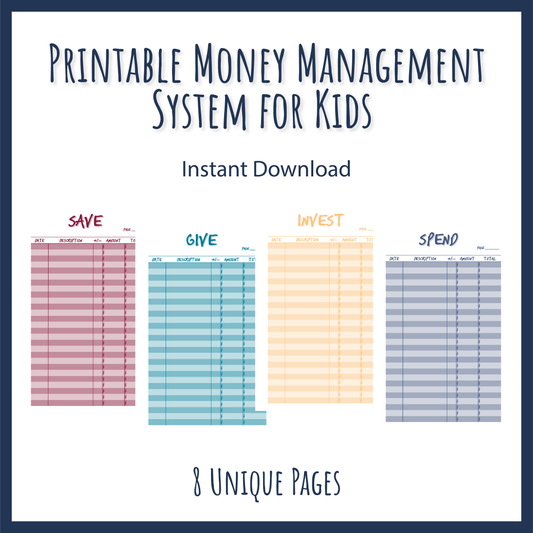

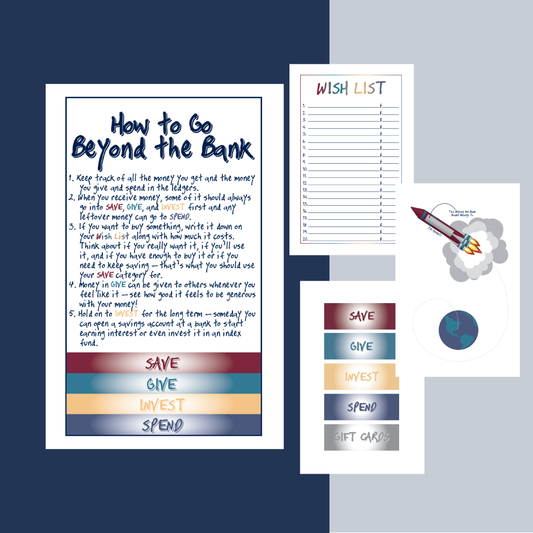

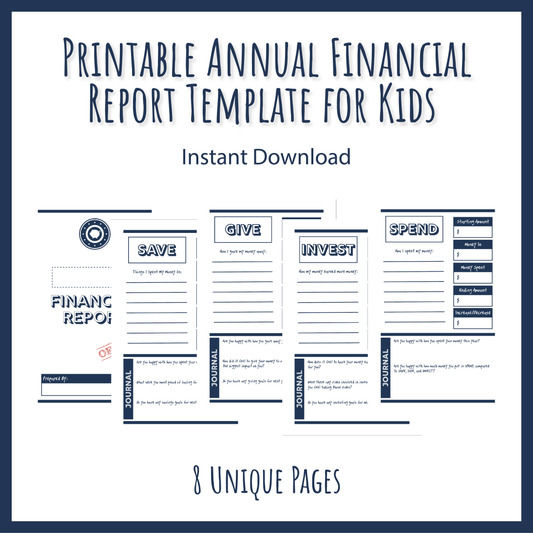

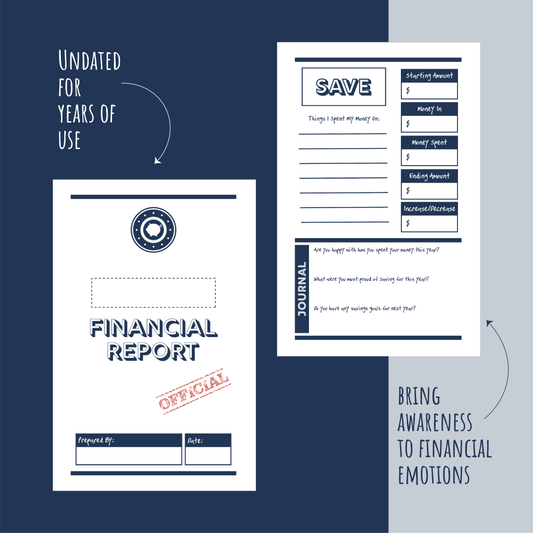

Money Management Tools for Kids

No matter where you are on your financial journey, now is the time to start teaching your kids about money! Studies have shown that by the age of 7, kids have already formed many of the money concepts that will define their financial behaviors as adults, and kids as young as 4 or 5 are capable of starting to take responsibility for their money.

Kids have their whole lives in front of them to benefit from the magic of compound interest and helping them to develop a healthy mindset and good habits will let them leverage that magic even more.

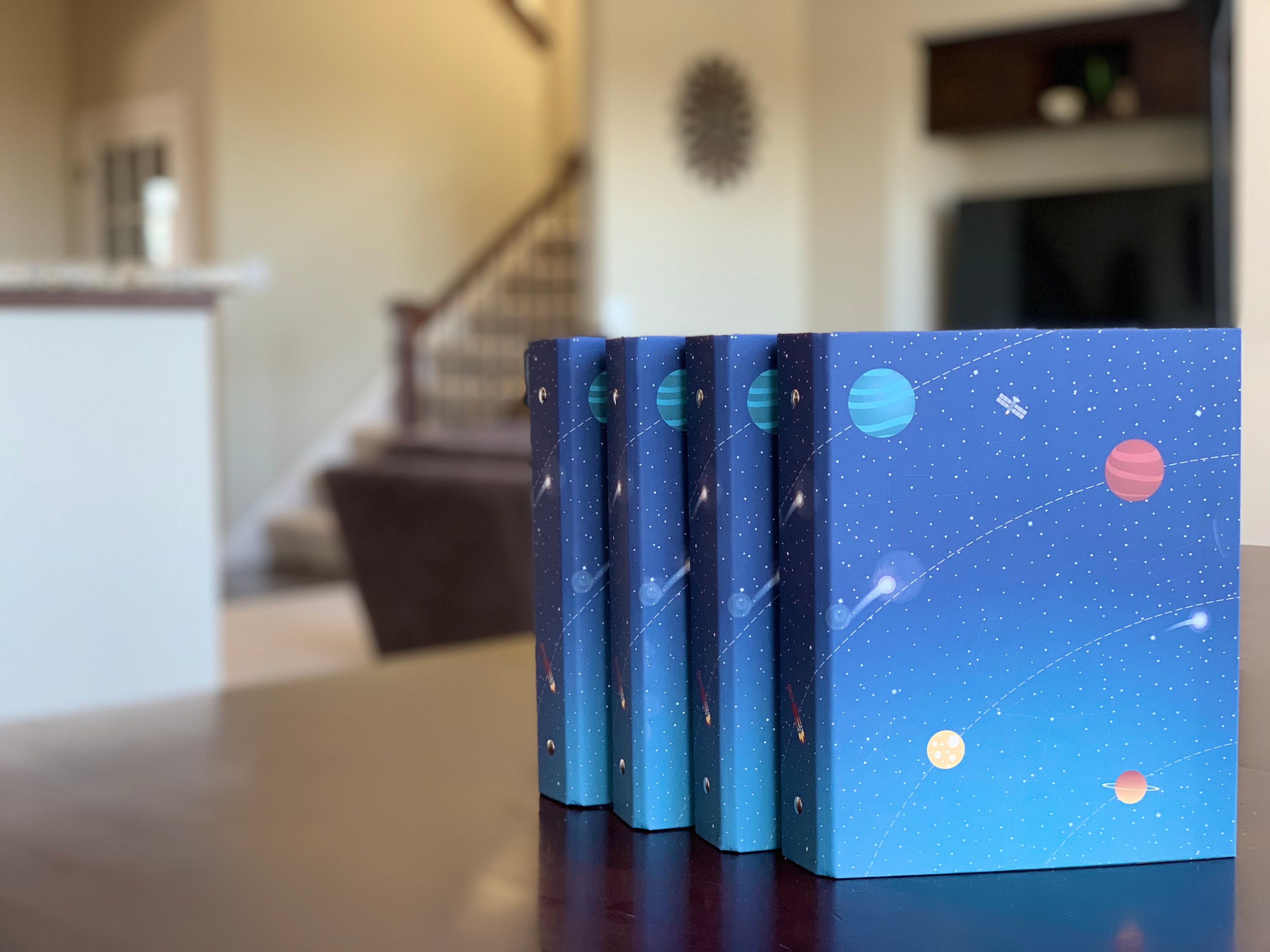

Whether you use a Beyond the Bank money management binder, or a set of jars or envelopes and our printable system, it's time to give your child the gift of financial literacy!